Our Home Budget Tracker helps you efficiently manage day to day spending. Use it to input receipts, track account balances, stick to your budget, and reconcile statements. Designed to be used by individuals and couples on the go at any stage of life.

Home Budget Tracker is provided 100% free for you to use during the initial release phase. We use it ourselves and are busy adding additional features. Eventually we do plan to offer a premium version at a very reasonable price, but there will always be a free plan available. Your data is 100% yours, you can export at any time. Users who participate during this phase get a chance to provide input and shape what features we work on. You will also get a nice discount as a thank if you do decide to go premium.

Features we are planning on adding (in no particular order):

- Improved support for loan accounts and cashflow projections, support Mortgage escrow portion of payment, add HELOCs and other types of loan accounts

- Integration of budget with our Income Spending Simulator for cashflow projection

- Budget screen - show debt reduction, projected cashflow

- Allow image / document upload with a Transaction

- Sync with bank and credit card accounts (this one is tricky for security and can be costly for us)

- Additional reports

Let us know if you what you are most interested in or have other feedback and we will incorporate it into the plan.

Release History:

- 1.3.1 February 18th, 2023

- Added Income and Expense Graph under Reports.

- 1.3.0 December 26th, 2022

- Copy transaction - select a single row on account listing then click the Copy button in the bar above.

- Ability to rebuild Budget Screen categories based on defaults, see new button under the Tools menu.

- 1.2.1 November 23rd, 2022

- Minor UI fixes, report updates.

- Minor UI fixes, report updates.

- 1.2.0 August 13th, 2022

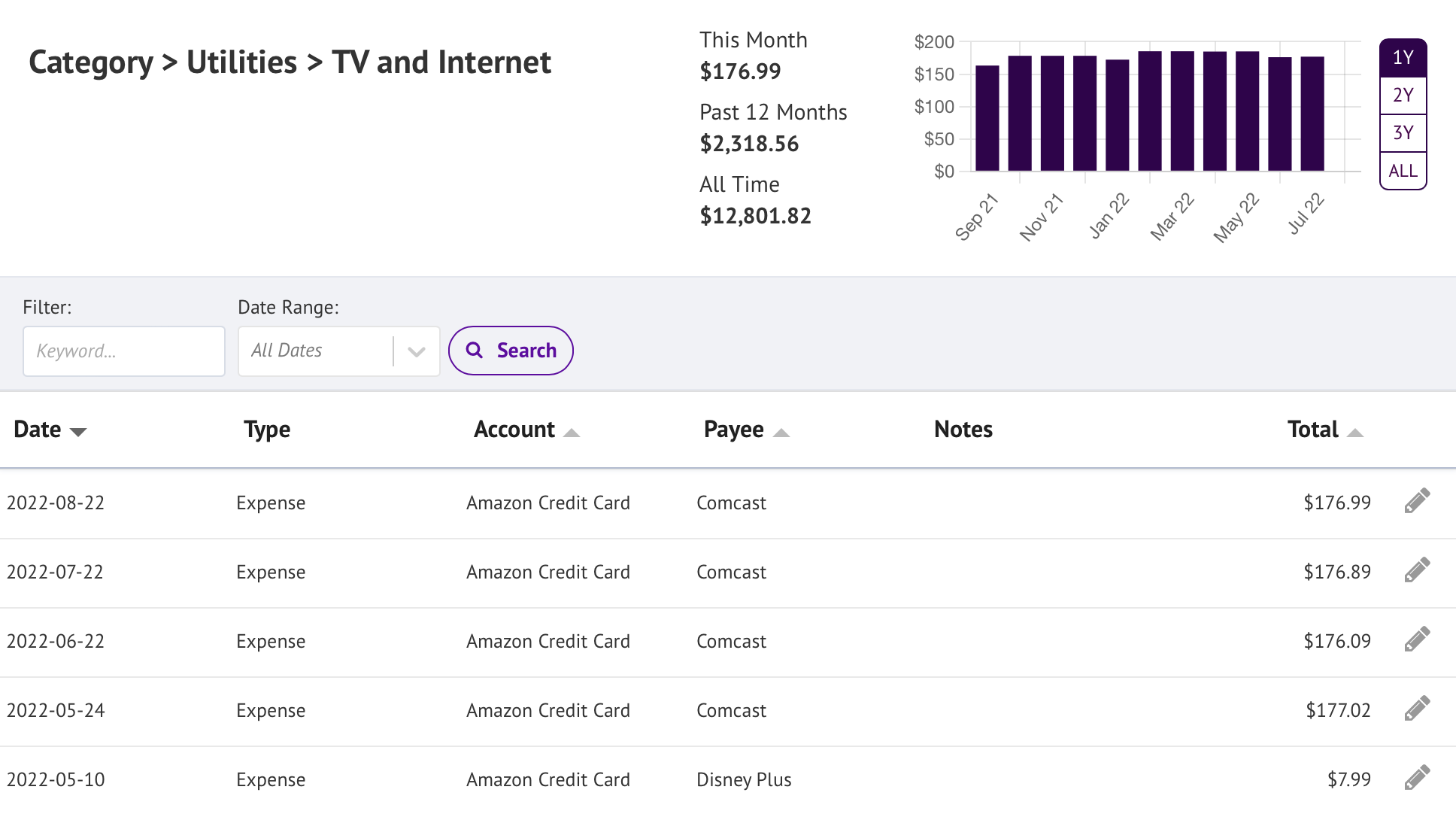

- Payees and Categories get a graph / histogram of transactions. Ability to filter by 1 year, 2 year, 3 year or all time.

- Payees and Categories get a graph / histogram of transactions. Ability to filter by 1 year, 2 year, 3 year or all time.

- 1.1.0 July 15th, 2022

- Reports section added

- Balance sheet report

- Category Summary

- Payee Summary

- Fixes

- Budget screen - include refunds in the budget category line total.

- UI fixes for scroll bars

- Other minor fixes

- Reports section added

- 1.0.2 May 31st, 2022

- Corrects sorting of transactions that share the same date.

- Increase backend request limit. Show error message if user is clicking around too fast.

- Minor UI and navigation cleanup.

- Two factor authentication introduced site wide!

- 1.0.1 May 23rd, 2022

- Payees and Categories transaction listing shows a summary of spending by month, year, and all time.

- Budget screen - adds tab for transfer transactions.

- UI fixes / improvements.

- 1.0 May 8th, 2022

- Initial release!

- Budgets - monthly and annually

- Transactions - by Account, by Category, by Payee

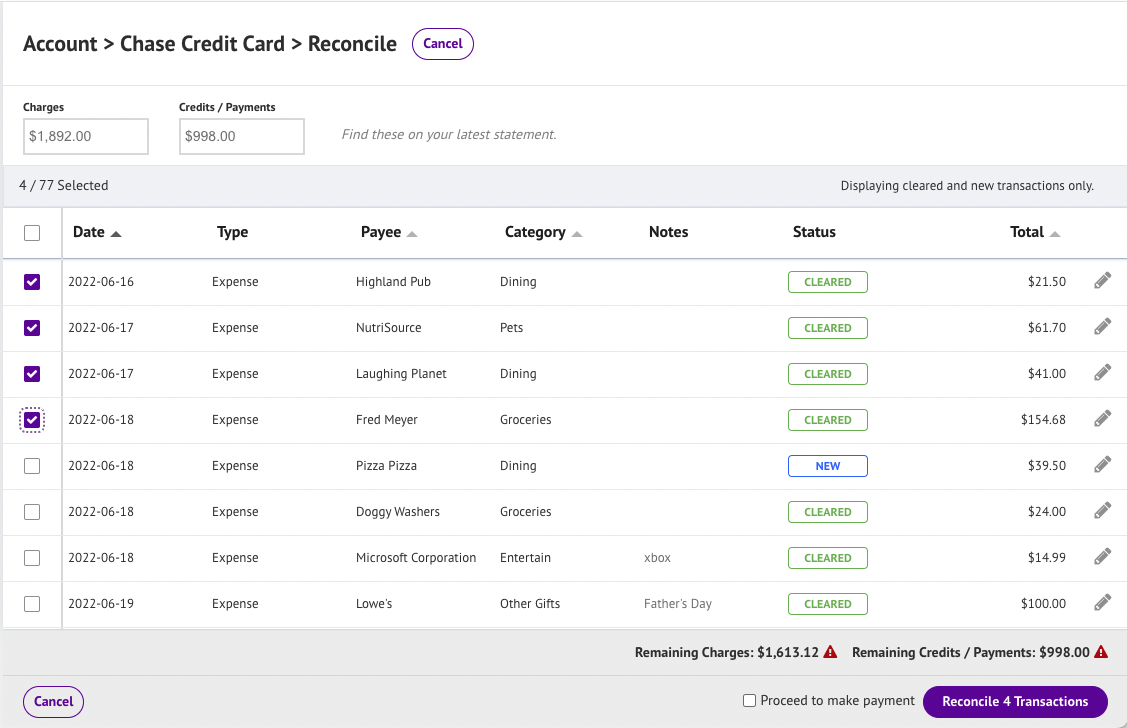

- Accounts - manage, sort, toggle visibility, reconcile transactions

- Categories and Groups - manage, sort, toggle visibility

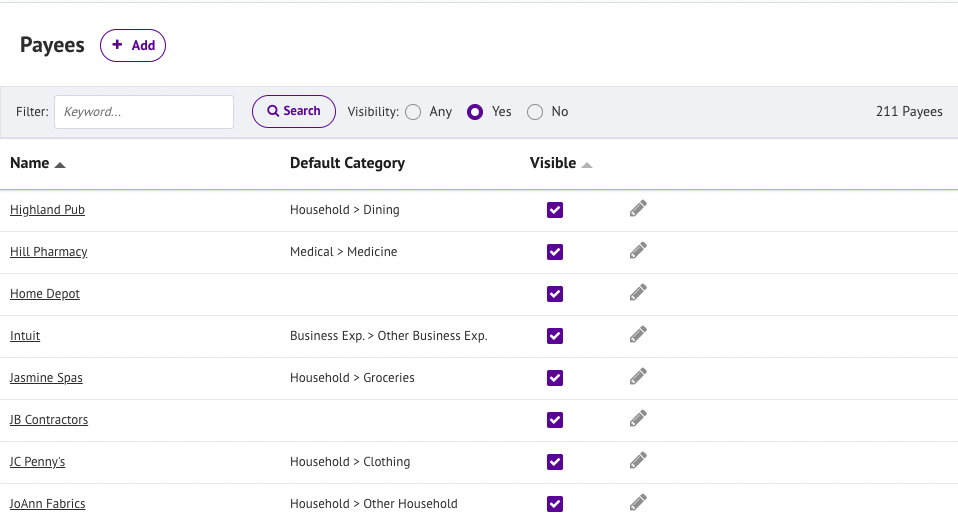

- Payees - manage, set default category, toggle visibility

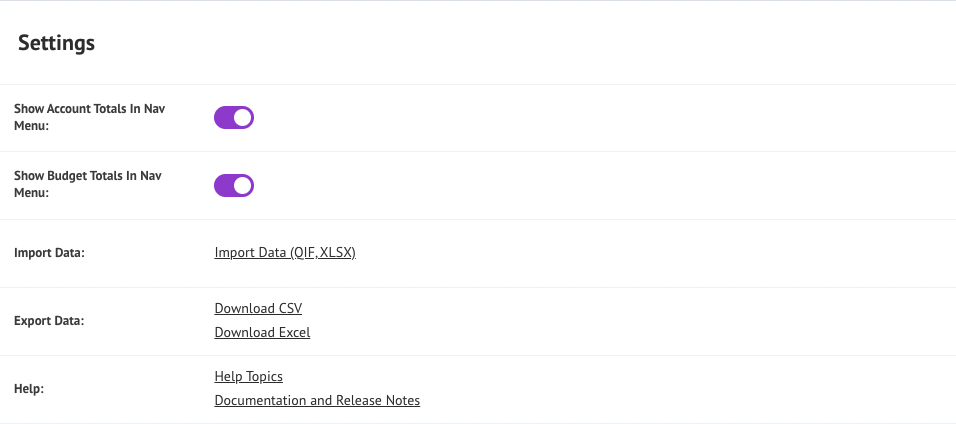

- Import XLSX / QIF format

Help Topics:

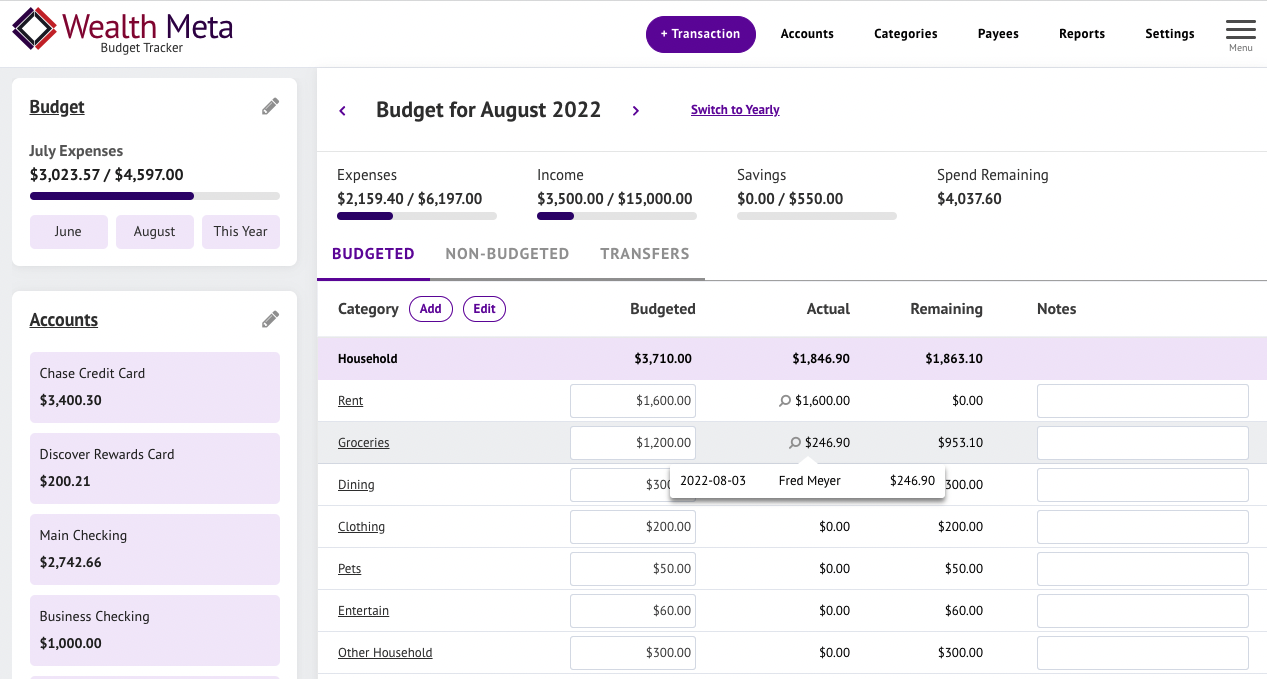

The first time you launch the Budget Tracker you will be presented with a set of questions to configure our budget. Everything you enter here is configurable later.

If you are planning on importing from Excel (XLXS) or Quicken (QIF) you can click through these screens and then head to the Import Data page.

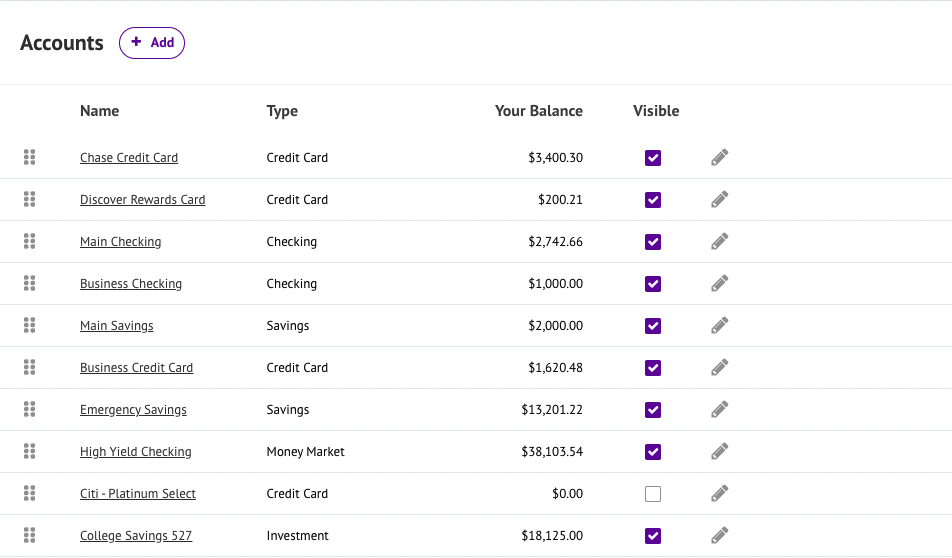

One of the first things you will want to do is setup all your accounts associated with your budget. These include:

- Checking accounts

- Savings accounts

- Other savings accounts (money market, certificate of deposit, etc)

- Credit card accounts

- Loans (mortgage, auto, student loans, etc)

For credit card accounts, if you don't know your credit limit, interest rate, etc that is okay just leave it blank.

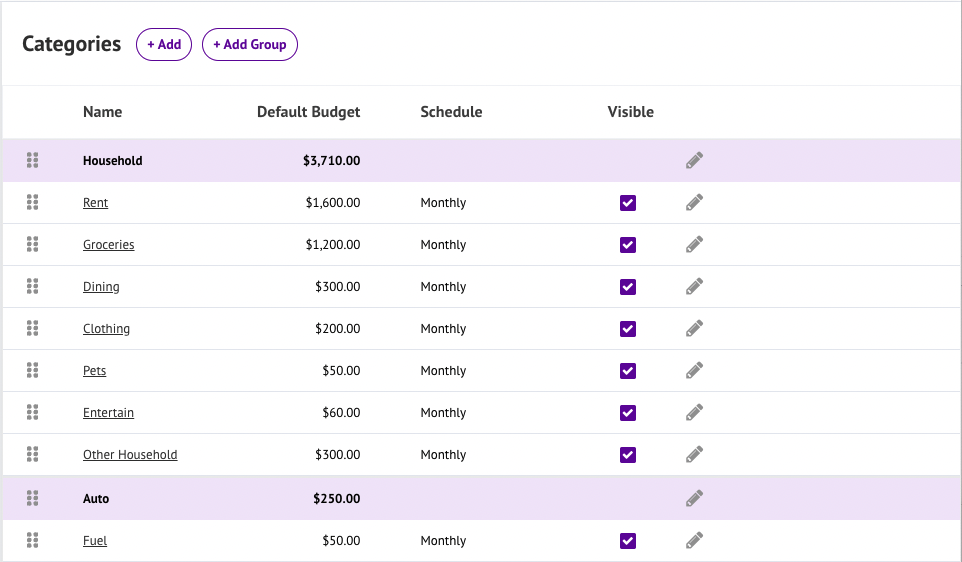

Every time a transaction is entered it should have a category that determines how it fits into your budget (groceries, rent, etc).

Categories are broken up into groups. Every category must be in a group. Common groupings are Household, Housing, Transportation, Utilities, Savings, etc. Another popular grouping is Needs, Wants and Savings.

You can configure categories and category groups however you like. On the Categories screen you can drag and drop categories within a group, or across groups to reorder them.

For the purposes of your budget, categories can be scheduled in the following ways:

- Monthly - this category will appear on your budget every month

- Yearly - this category will only appear in your yearly budget

- None - this category will not appear anywhere in your budget

- Scheduled - pick which months this category is budgeted for

Payees are who or what business a purchase goes towards. Payees are automatically collected when you enter transactions.

A default category can be set on a Payee to save time when entering transactions.

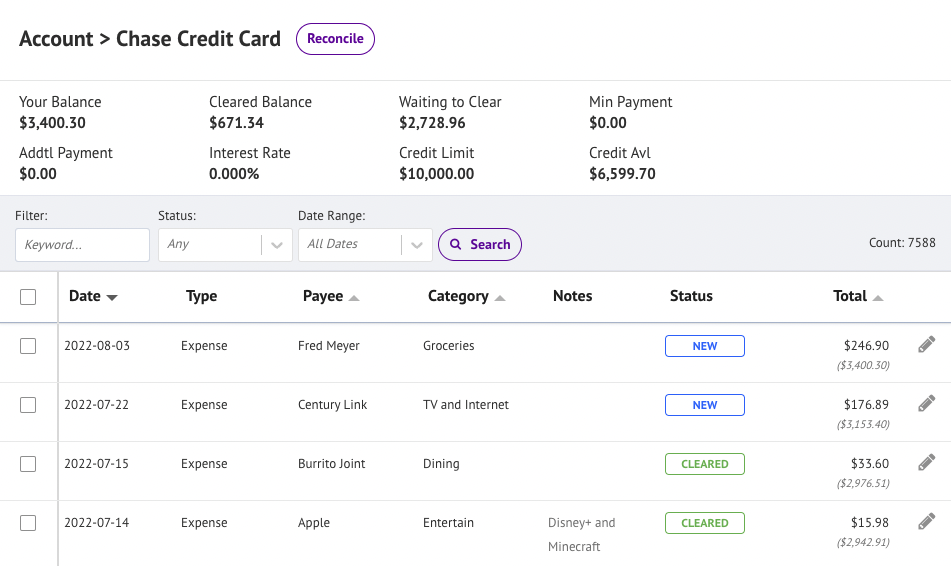

The main activity in Budget Tracker will be entering your transactions.

Always enter a positive value in the amount field.

New Categories and Payees are auto created using the Add Transaction dialog.

Budget Tracker supports splitting a transaction across multiple categories. For example, if your trip to the grocery store included food and some party items (entertainment) you can break up the total so your budget will reflect the right amounts.

For a transaction to appear on your budget it must have a category. So you'll want to categorize certain transfer transactions such as transferring money to a specific savings account.

Your budget is computed each month based on the categories that are scheduled for that month. As transactions are entered, the total for each category and the remaining amount to spend is updated.

Transactions tied to a category that isn't part of a budget item show up under the non-budgeted tab.

The budget screen can also be toggled into yearly mode which will include annual budget expenditures.

Budget line amounts can be adjusted and notes can be added. These changes apply only to the current month/year being viewed. To change a budgeted amount for future months, edit the category's budget settings.

Your Budget Tracker data is available in Excel XLSX format or CSV format under Settings -> Export Data. You can also obtain your data under My Account -> Profile Settings -> Download Data.

The Excel export format is the same as Budget Tracker's import format. So if you want to cleanup or reorganize your data one strategy is to export, cleanup manually, then re-import.

The CSV format is transaction data including account / payee / category data.

Accounts, Categories and Payees can have their visibility toggled.

When visible is not checked the record are still in the system, but it will not appear in drop down boxes or navigation. This is a handy way to get rid of old or rarely used items (but keep the associated transaction data).

Budget Tracker does not currently integrate with external financial institutions (banks, credit card companies, etc.) So at this point we don't ask for account numbers or the official names of your financial institutions since that isn't useful to your budget. Your data is secure and backed up with Wealth Meta. Our privacy policy states that we will not sell your data.

As we say in our welcome letter:

You too need to take smart security precautions in order to protect your online identity and account at Wealth Meta. Here are our recommendations:

- Pick an anonymous ‘handle’ as your username to identify yourself (for example the name of your pet, favorite food, or something amusing but not offensive).

- The same goes for your profile picture (don’t upload your passport photo or anything sensitive that you don’t want associated with your data, also keep it clean).

- Use an email address dedicated to your financial life only, not the same email you use for social media.

- Set a strong password you don’t use anywhere else, and lock it in a password manager program that is backed up.

- For more ideas on protecting yourself online, see our article Lock Your Digital Windows and Doors: Basics of Digital Security

Your username, profile picture, email and password can all be changed under your profile at any time.

Got Feedback?

We would be happy to incorporate your feedback into an upcoming release.