ETFs for Bitcoin and Other Cryptocurrencies

- April 22, 2021

- by Michael

There are several ETFs available for investing in crypto currencies. See the list below and a discussion of the pros and cons of investing in cryptocurrency this way.

The crypto currency market has grown exponentially over the past few years. Crypto is WAY past meme status and is in the process of going mainstream on Wall Street. No doubt this part of the recent price increases across the board.

Investors interested in cryptocurrencies like Bitcoin and Ethereum are now starting to take advantage of exchange-traded funds (ETFs) to deploy their capital. The idea that an ETF can track Bitcoin only increases its popularity and drives up the price further.

With over 1,000 cryptocurrencies that are available to invest in, ETFs provide the ideal way to avoid investing in digital assets individually. ETFs trade like a stock through your broker and don’t require a crypto wallet or a special app.

As of April 2021 there are over 100 crypto currencies with a market cap of over $1B!

If you’re looking to invest in Bitcoin or other cryptocurrencies through ETFs, here’s all you need to know about it. Scroll down for a detailed guide on crypto ETFs, the best funds to invest in, along with the pros and cons of such investments.

How Do Crypto ETFs Work?

An ETF is essentially a fund that sells shares to investors. Shares of these funds trade like stocks and can be bought or sold through a brokerage account (taxable or tax-deferred) when the market is open. A crypto ETF provides a way of owning crypto currency through your brokerage account. The main benefit being crypto ETFs held in a tax deferred account enjoys the same tax treatment on gains as any other stock or mutual fund.

Note that not all ‘crypto ETFs’ are true ETFs and may be structured as a closed end fund, a grantor trust, or other instrument that trades over the counter (OTC). We’ll refer to them here as ETFs even though under the hood they may work a little differently - read the prospectus so you know what you are buying!

A crypto ETF tracks a digital currency’s market value (in theory). Some track a single crypto currency (bitcoin, ethereum). Others track a basket / blend of several cryptocurrencies. These funds allow you to invest in cryptocurrency without personally holding it. They work similar to gold and silver ETFs where you can own precious metals on paper, but they are actually held in a vault by the ETFs management company. EFTs are NOT the same thing as direct ownership, but the returns should be similar (again in theory). It is up to you to understand the way the fund operates by always reading the prospectus BEFORE buying. Analogous to precious metal ETFs, a crypto currency ETF helps to eliminate security and storage complexities that come up with regular cryptocurrency investing.

Here is a list of ETFs (or OTC funds) for investing in Bitcoin and other cryptocurrencies.

| Ticker Symbol | Name | Expense Ratio / Fee | Holdings | Fund Size (4/2021) |

|---|---|---|---|---|

| GBTC | Grayscale Bitcoin Trust | 2% | Bitcoin | $36B |

| ETHE | Grayscale Ethereum Trust | 2.5% | Ethereum | $6.9B |

| GDLC | Grayscale Digital Large Cap | 2.5% | Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Chainlink | $537M |

| LTCN | Grayscale Litecoin Trust | 2.5% | Litecoin | $398M |

| BCHG | Grayscale Bitcoin Cash Trust | 2.5% | Bitcoin Cash | $281M |

| OTBC | Osprey Funds | 0.49% + 0.3% | Bitcoin | $160M |

| BTCC | Purpose Bitcoin ETF | 1.0% | Bitcoin | $1.05B |

| ETHH | Purpose Ether ETF | 1.0% | Ethereum | $25M |

| BITW | Bitwise 10 Crypto Index Fund | 2.5% | Tracks Index comprised of the 10 most highly valued cryptocurrencies | $1.0B |

What are the Benefits of Crypto ETFs?

1. Simplified Trading

Investing in any Bitcoin ETF offers exposure to Bitcoin’s existing price without the hassle of how it works under the hood. If you know how to buy and sell stocks through your brokerage account, you know how to buy into the fund.

2. Security

With ETFs, investors do not need to sign up for a cryptocurrency exchange or take any risk of owning cryptocurrency directly.

For instance, if you have invested in a particular digital currency, you must keep track of your wallet’s credentials. If you lose access to the wallet, your investment is lost and untraceable in most cases.

3. Tax Deferred Accounts

Since cryptocurrency is decentralized and highly unregulated, if you trade it using a personal account you will be taxed on short term / long term gains when you sell.

Since ETFs work like stocks you can trade them using your tax deferred brokerage account (IRA, Roth IRA, etc). This makes the gains tax free!

Are There Any Cons to Crypto ETFs?

Any “pro” on wall street comes with a price. As the saying goes, there is no free lunch on Wall Street. Crypto ETFs have certain drawbacks that you must bear in mind before you invest in them.

1. Management Fees

Most ETFs / funds charge management fees for their services. Annual fees on ‘exotic’ instruments tend to be much higher than your bargain basement Vanguard index ETF. So expect to pay more over time which cuts into your overall return.

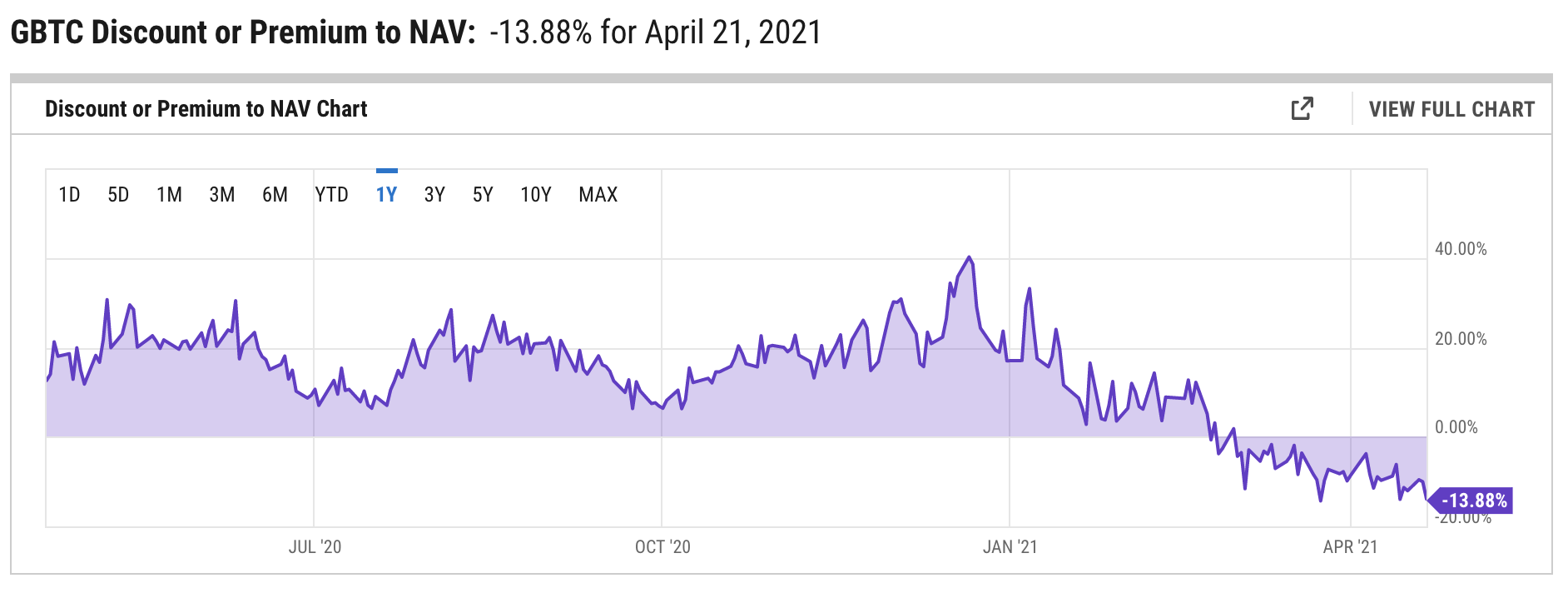

2. Price Inaccuracy and Net Asset Value Discrepancies

Most ETFs track an asset’s price effectively. With crypto ETFs the market price compared to the “net asset value” NAV tends to fluctuate. Given the insane demand lately some crypto currency ETFs are trading at what could be considered astronomically high values compared to the underlying assets.

Let’s start with an example to explain NAV and premium vs discount. If the price of bitcoin is $100k and “Bitcoin Fund ABC” owns 10 bitcoin its NAV would be $100,000 * 10 = $1,000,000. If there were 1 million shares outstanding, then in theory a fair price would be $1/share. If it were trading at $1.10 that would be a 10% premium (fund is expensive relative to the underlying assets). If it were trading at $0.90 that would be a 10% discount (fund is cheap compared to the underlying assets).

Here is a link to the discount/premium chart for GBTC. As you can see it moves a lot, it used to be at a premium and is currently at a discount.

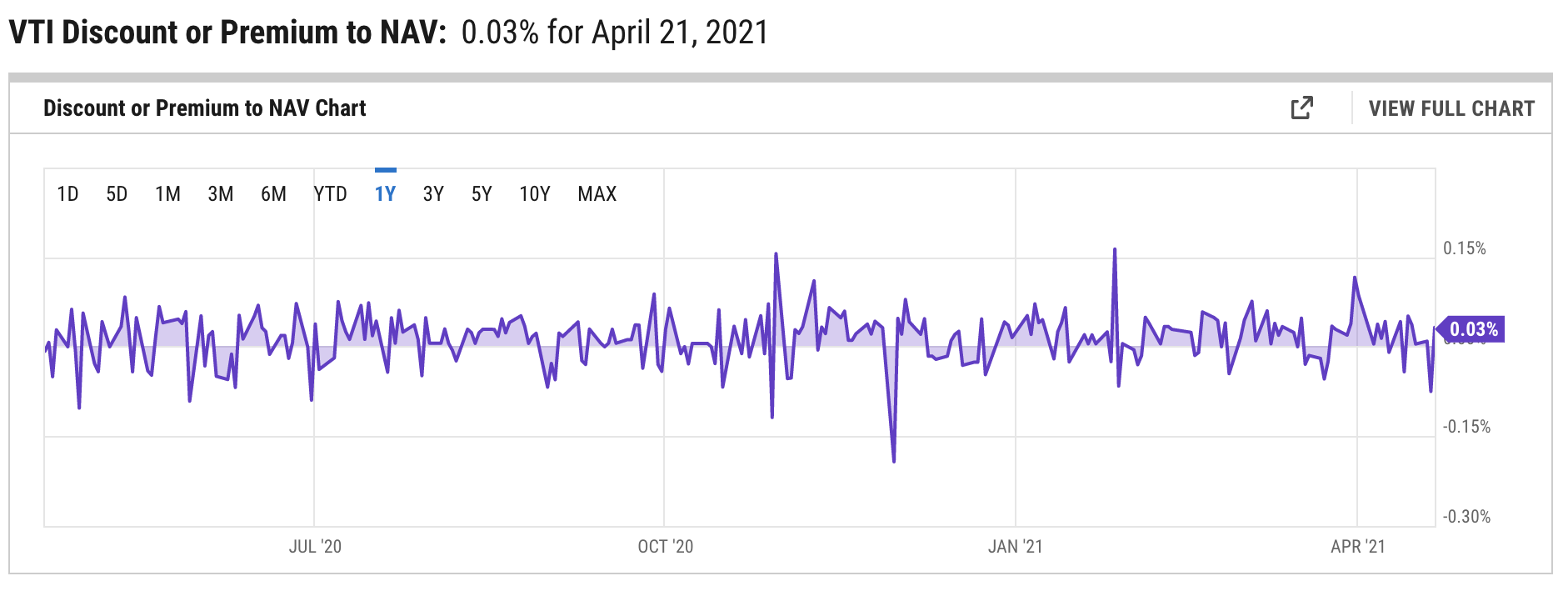

Compare this to the premium/discount chart for VTI, one of Vanguard’s most popular total market ETFs. It stays in a much tighter band.

Now check out what is going on with Grayscale Litecoin Trust (scroll down to see the chart). LTCN has a history of trading WAY over the NAV, currently at about a 1000% premium! Investors are throwing money at this without even considering the actual value of its Litecoin holdings. Before you buy into a crypto fund it makes sense to check the current NAV and evaluate if it is a good deal for your investment goals.

3. Lack of Flexibility

If you own an actual crypto currency it has inherent purchasing power. For example with Bitcoin you can buy a Tesla, or convert it to another crypto currency like Litecoin, Ethereum, etc.

With an ETF the only thing you can do is sell it and get the dollar value. This is because the ETF is meant to track the cryptocurrency’s price and not aid in actually obtaining it. For very large lots of shares there may be a mechanism for ‘redemption’ where you could take delivery of the actual underlying cryptocurrency, but it would be complex, costly and slow.

4. Lack of anonymity

Since cryptocurrencies are independent of banks, equities, and fiat currencies, they offer a manner of financial anonymity when using them.

ETFs, on the other hand, are heavily regulated, taxed in regular brokerage accounts, and designed such that a chain of ownership can always be traced.

5. Lack of assurances

Leading cryptocurrencies like Ethereum and Bitcoin are unregulated and thus can be extremely unpredictable. Besides the uncertain price movements, the safety of the fund’s digital assets may also be threatened by cyber attacks. A large collection of crypto currency tokens would make a juicy target for hackers. If something goes horribly wrong with the fund’s holdings you may be left “holding the bag”.

What about investing in the technology behind bitcoin / cryptocurrency?

Another way to bet on crypto currency is to ignore the currency itself and instead bet on the companies selling the shovels.

Here is a list of ETFs or companies involved with crypto fintech or block chain technology (which Bitcoin runs on top of):

| Ticker Symbol | Name | Expense Ratio | Holdings | Fund Size / Market Cap (April 21, 2021) |

|---|---|---|---|---|

| COIN | Coinbase | n/a | Coinbase company shares - a crypto exchange platform | $58B |

| RIOT | Riot Blockchain | n/a | Bitcoin mining | $3.4B |

| MARA | Marathon Digital Holdings | n/a | Bitcoin & crypto mining | $3.3B |

| BLOK | Amplify Transformational Data Sharing ETF | 0.71% | Blockchain technology companies | $1.1B |

| BLCN | Reality Shares Nasdaq NexGen Economy ETF | 0.68% | Blockchain technology companies | $278M |

| LEGR | First Trust Indxx Innovative Transaction & Process ETF | 0.65% | Indxx Blockchain Index | $81M |

| KOIN | Capital Link Global Fintech Leaders ETF | 0.95% | ATFI Global NextGen Fintech Index | $26M |

The crypto currency market is continually evolving. We will work to keep these lists up to date. Please comment below if something new comes along that we should include.

For full transparency Wealth Meta staff do not own any of these funds / stocks mentioned in this post at the time of writing (April 22nd, 2021). Do your own research before making any investment decision and consult your financial advisor.