What a Legal Expert Has to Say About Popular Scams and Con Games

- July 6, 2018

- by Michael

When it comes to money, if it seems unusual or too good to be true, it means you are being targeted by a scammer. This post explains a few scams that rely on financial ignorance that we hope you will now be able to recognize and avoid.

At Wealth Meta we are all about promoting financial literacy. Typically this refers to understanding how to set a budget, track your net worth, and manage your money so it works for you. However financial literacy also means understanding how to protect yourself from the multitude of predators that are out there trying to make a quick buck off you (often illegally).

We asked for some input on the topic of scams from an expert attorney, Jack Platten, whose career has been focused on securities and business law. He shared a few of the most common con games he has seen over the years.

The scam of mistaking “funds available” from a check deposit for actual money in your account:

“I see several of wannabe check scams every year. The rely on the fact that when you deposit a check in a lawyer's trust account (or your personal account) the bank may show the funds as being available, but in fact, particularly with an overseas check, or one from something other than a US mainstream bank, the funds are not actually in your account for somewhat longer than the "funds available" seems to indicate. If you write a check, including a refund check on those funds, you are at risk of losing your funds, or bouncing a check.

“A common opening to these games sent to attorneys is an innocent inquiry "do you prepare purchase and sale contracts for ..." I have had attempted openings for this scam relating to fishing boats, ocean drilling rigs and a couple of others in the past two years. Anything such as an airplane, ship (or private boat, or movable heavy equipment) is a common vehicle to use for these scams, because they are movable, have complicated paperwork to change actual ownership, and you may not be able to quickly nail down the ownership if it is another country.”

The moral here is, even though your bank says funds available that isn't really true. Checks that come from out of state or other countries can take weeks to bounce.

The check that was mistakenly “too big” will invariably bounce on you:

This scam is similar to the above but targets small landlords or people trying to rent a room in their home.

My mother in law was trying to rent out a room in her place. She advertised on reputable housing boards online. Within a few days someone from several states away contacted her and was very interested in the place. They said their dad was paying for them to go to nursing school, he would be paying the rent in advance, and they wanted to secure the room immediately.

The security deposit was $1000, but for some reason the check they sent was $1800. That is $800 too high, and it was an out of state check. This should set off alarm bells. When my mother in law asked them to send a check in the correct amount they said they couldn’t with some excuse about dad being sick. Instead the scammer asked my mother in law to cash the original check and send back $800. My mother in law said no, and then they went dark.

The scam is you would deposit the check thinking the funds are available, then write a check out of your account for $800 back to the scammer. Then the original check you got from the scammer bounces a week later and you are out $800 plus bank fees...

Hard money loans with a “Guaranteed Return”:

Here is a scam where you are asked to loan someone money on great terms in order to secure a property or other asset:

“One area of common scams, which seems to come and go with the real estate market and the contracting business is the "hard money" loan. These show up, for example, by realtors, mortgage brokers and others offering a chance to put up money to finance buying a house, constructing a house or commercial building, etc.

“The pitch is usually "ABC contractor can't get a commercial loan to buy (or tie up, or get an option, etc.)" because:

- He has some past problem.

- He doesn't want his ex-wife to know about his business.

- The banks take too long to make decisions and this is an opportunity which has to be taken advantage of right now!

“Several people, typically, will give money to the scammer who then buys or at least ties up a piece of property.

“The key is that the scammer then doesn't record a mortgage on the property, because he wants to borrow from a bank. He takes the money, uses it to convince the bank (or other lender) that he is making a big equity investment, so the bank will make a loan.

“Then he resells the property and keeps all the money. The people who gave him the "hard money" loan find out that they actually never had any enforceable lien on the real property. The scammer takes his money and leaves town. There are a lot of variations of this.

“Whenever you get a pitch that says "This is a secure investment, you will be in a first lien position" and the interest they are paying is more (usually much more) than the market rate - it has to be a lie. If it were a secure investment, and the borrower was a good risk, a bank would loan the money for less than he's offering you.“

The moral here is if you are going to loan someone money, make sure you get collateral in writing as part of the deal. That would require having your own lawyer review the paperwork. If someone is not comfortable with a lawyer reviewing their contract, they fail the basic test of doing business with them. If you are hesitant to pay for legal representation just consider it is somewhere between ten and a million times cheaper to stay out of trouble (and do things correctly) than it is to get ripped off by a scam artist.

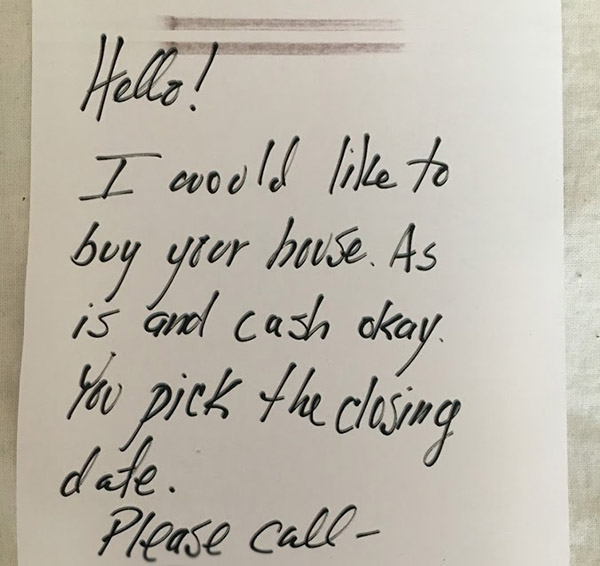

Why a note saying "I'll buy your house in cash" is a scam:

I got this note on my door a few weeks ago:

Jack’s take on this:

“The scam is that they greatly low ball you on the price, and then immediately sell it. Maybe the scammer already has a buyer, who doesn't know the house is someone else’s, or the scammer is a licensed real estate agent.

”This is very common in a housing "bubble" which occurs every so often. One of the clues of a bubble is always the number of licensed real estate salesmen. The number will go up by 300 to 500 percent and then drop drastically when the hot market goes away. Many of those licensees are unaware of how precarious a business it is when the market drops, and it always does, eventually.

”The last time the real estate marked dropped was particularly vicious. Lots of the newly licensed agents are buyers, and the whole thing is like musical chairs. Invariably people are left holding an overpriced house, with payments they can't afford. When the music stops suddenly they can't resell the property at a profit or even make the payments. Right now (July 2018), I think we are getting to the top of the market, and the people who buy are apt to get stuck that way.

”If you have a really nasty sense of humor, the end of the game is funny. Those flippers who get into the game late, or who are too greedy and keep thinking they can do it one more time, wind up getting stuck with a house, for which they paid much more than they can sell it for; they probably had only short term financing which will come due in a year or so, and they can't get out.

”There is an old saying in the investment business. Bulls (who expect things to go up) make money. Bears (who expect things to go down) make money. Pigs (who try to squeeze the last penny out of a deal) get slaughtered. By and large that is true.”