Angela

Dallas Texas

Writing about personal finance and money matters to help you meet your goals! I look forward to hearing from you in the comments.

Blog Posts by Angela:

- December 14, 2024

- by Angela

5 Financial Hacks for Recent College Graduates

The real problem with money arises after graduation when you officially become an adult. It’s time to start thinking about how to earn money to pay back your student loans and also how to pay …

- October 17, 2024

- by Angela

Love & Money: 4 Steps to Financial Compatibility

It pays to talk with your partner about money, specifically how you will use money jointly. In the following lines, you will read about steps that can help you with marital financial compatibility.

- August 11, 2024

- by Angela

Why You Shouldn’t Skip Out on Wedding Insurance

Wedding insurance is a financial contract that protects you from financial loss if your wedding day is canceled or something happens outside of your control.

- March 23, 2024

- by Angela

What Is Mortgage Insurance and How to Avoid

Mortgage insurance is an annoying charge some first time home buyers might see as part of their payment. It can eat into your budget and make homes less affordable. Getting out of it is possible …

- February 13, 2024

- by Angela

Crowd Sourced Real Estate Investing

A new trend in real estate investing is somewhere between owning a property outright and buying a REIT ETF or mutual fund. It is called “crowd-sourced” real estate investing.

- January 8, 2024

- by Angela

Investing for Beginners

The secret to investing is to get started early and make it automatic. It doesn’t have to be much. Once you get in the habit it begins to snowball. But where can you invest money …

- November 12, 2023

- by Angela

The Psychology of Money: Saving and Spending Habits

Lack of savings can be from a small income or because they simply don't know how to budget. No matter your income you need to understand the psychology of money in order to save and …

- October 2, 2023

- by Angela

Digital Wallets - Convenience and Security

With the advent of smartphones came the invention of digital wallets. We are close to saying goodbye to carrying cash and credit cards. What are digital wallets? How are they used? How safe is their …

- September 20, 2023

- by Angela

12 Money Matters to Discuss Before Marriage

The most sensitive topic for young people before marriage is the topic of money. Many are afraid to bring up the subject for fear of offending their partner if he or she has less money …

- September 12, 2023

- by Angela

Car Lease vs Loan: What Should I Choose?

Many people are thinking about buying a car, but they are not sure how to go about financing it. Should they do it with the help of a car lease or should you apply for …

- August 16, 2023

- by Angela

12 Ways to Save Money on a Tight Budget

Are you living on a tight budget because of the squeeze from inflation? Is your credit card balance rising each month? It can be difficult to save with stagnant wages and rising prices. Here are …

- August 2, 2023

- by Angela

Work From Home Benefits for Companies and Employees

Once it was unthinkable to work from home, today it is common. In the past, only freelancers worked from home, but today this work model is practiced by many industries. Before the pandemic, only 6% …

- July 12, 2023

- by Angela

How to Get Rid of Debt Without Paying

There are a few options to get out of debt without paying. Student loans have the best options. It is possible with some types of other debt but not all. How to do it? You …

- June 27, 2023

- by Angela

7 Mistakes Investors Make to Nope Out Of

7 common investing mistakes explained: comparing yourself to others, being emotional, timing the market, ignoring cashflow, not rolling over employer 401k, missing employer matches, not contributing!

- June 20, 2023

- by Angela

Popular Budgeting Apps and Pricing 2023

Here is a breakdown of popular budgeting apps and what they cost. There is a wide range of cost, features, and ease of use in the world of personal accounting software. The most expensive is …

- May 22, 2023

- by Angela

Bartering: And Old but Good Financial Strategy

Barter is the exchange of goods and services without using money. It has been around since 6000 B.C. but still has its place in society today. One huge advantage is there are no taxes on …

- May 3, 2023

- by Angela

T-Bills or a Boat - Which Will You Regret More?

Today we explore the age old question: is it better to buy T-bills or a boat? What pays more? What will we regret more? In the following lines I'll go into the details of these …

- April 21, 2023

- by Angela

The Dirty Secrets of Credit Card Companies

Credit card companies profit from their customer’s miseries… It is sad, but it all comes down to the fine print in the agreement. In this post I cover 8 ways credit card companies end up …

- April 10, 2023

- by Angela

Financial Mistakes People Make (And How to Avoid)

Can people make ridiculous financial mistakes? Of course, it is a daily occurrence all across the world. Some of these can actually look pretty funny to those who have mastered their personal finances.

- March 31, 2023

- by Angela

Budgeting Myth vs Fact - You Wish You Knew

Why is budgeting so easily avoided for some people? Some think they won't have money left over for any fun or entertainment. Others think they are too young to plan for retirement, it being so …

- February 21, 2023

- by Angela

Tips for Bicycle Touring on a Budget

In order to have a successful cycling tour, you need to have a certain budget and a plan to make your dream come true. If you are a cyclist and have this dream, these are …

- February 6, 2023

- by Angela

Cars - Gas vs Hybrid vs PHEVs

Some simple math can help us tell if a hybrid car is worth buying. It all depends on the price of gas and how much you drive. What are plugin hybrid vehicles? Why are PHEVs …

- January 24, 2023

- by Angela

Planning for Home Maintenance

Here is a complete breakdown of all the costs that you will incur as a homeowner for a typical detached single family home. These include replacing the roof, painting the exterior, updating the plumbing, redoing …

- January 2, 2023

- by Angela

12 Tips for First Time Car Buyers

Many first-time car buyers seek advice from more experienced buyers such as family members or friends. That can lead to mixed results… as not everyone has the same priorities or knowledge of cars.

- December 15, 2022

- by Angela

15 Best Jobs for Teenagers To Consider While in School

Many teenagers want to earn money but not fall behind in school. For this reason, it is best for them to do part-time jobs. These jobs can help teenagers gain their first work experience, as …

- December 6, 2022

- by Angela

5 Tips for Getting the Best Mortgage

When you buy a house, repayment can take up to 30 years. In latin the term mortgage roughly translates to “death pledge”. That's why it's good to shop around for the best mortgage you can …

- November 22, 2022

- by Angela

10 Types of Home Loans To Know About

Are you in doubt about which mortgage is the best when buying a house? Depending on your situation you might be able to choose between several options. In this article I will outline the 10 …

- November 8, 2022

- by Angela

Investing - What Works and What Fails

One way to lose a bunch of money is to invest in just one thing, hoping to make a big profit in a short amount of time. The secret to investing is to spread it …

- September 20, 2022

- by Angela

Bonds vs CDs - Fixed Income Investing

When it comes to investing in Bonds or CDs there are a few things to consider. Both are fixed income investment vehicles with relatively low risk but there are important differences.

- September 8, 2022

- by Angela

Budgeting for Coffee

Just as a budget is allocated for food, clothes, and shoes, it is necessary to allocate a budget for coffee because coffee is a “must-have” in life, right?

- September 2, 2022

- by Angela

Budgeting Ideas for Teens

Budgeting is a skill that isn’t often taught in high school. Teenagers learn it through real life, either from role models, or by making budgeting mistakes. It is a skill they can use and benefit …

- August 28, 2022

- by Angela

Stocks vs Bonds: Similarities & Risks

I believe many don’t know the difference between stocks and bonds. What are stocks? What are bonds? What are the risks when investing in them? You will get answers to these and some other questions …

- August 19, 2022

- by Angela

Bank Statements - How and Why To Read Yours

Do you think banks are always 100% accurate when handling your money? With many thousands of clients and millions of transactions, the answer is they can’t possibly be perfect all the time. That is why …

- July 23, 2022

- by Angela

How Much Money Is Needed to Start a Business?

Many people think how nice it would be to have their own business. The first step is to determine how much money it takes to get the business off the ground.

- July 12, 2022

- by Angela

Two-Factor Authentication Rollout

What is a two-factor authenticator? Why is it important? What are the “Factors of Authentication”? What threats does 2FA address? What are the types of 2FA? Read on to learn the answers...

- June 29, 2022

- by Angela

Home Budget Tracker Tool is LIVE!!!

The Home Budget Tracker is now live! It works like any personal finance / accounting program to track your account balances, build a budget and monitor spending.

- May 28, 2022

- by Angela

Stocks vs Mutual Funds

Stocks and mutual funds are popular ways of investing in the pursuit of gaining wealth. Which investment is riskier? Which investment is safer? What is meant by mutual funds? These and other questions will be …

- April 21, 2022

- by Angela

ARM vs a Fixed-Rate Mortgage

When you get a mortgage there are two main types to consider. Do you want to take a loan with a fixed or adjustable rate? What are the advantages and disadvantages of both?

- March 30, 2022

- by Angela

401(k) vs. Roth 401(k): Which One Is Better?

In this article, I will talk about two retirement plans - 401(k) and 401(k) Rorth. At first glance they seem to be the same because they have 401(k) in their name, but in fact, there …

- March 15, 2022

- by Angela

Gross Income vs. Net Income

There are two types of income - net and gross. One is what you negotiate, the other is what you can spend. It is important to know the difference between the two when planning your …

- February 28, 2022

- by Angela

6 Ways to Improve for Investing IQ

Do you know anything about investing? Do you know how stock and bonds are used for retirement planning? Do you know how to avoid excessive fees? Below I’ll outline some essential concepts to increase your …

- February 14, 2022

- by Angela

How to Minimize Student Loans While in College

Read this article for ways college students can minimize their loans while studying, or importantly build a debt reduction strategy starting in high school.

- February 3, 2022

- by Angela

Reasons to Start Discussing Finance With Your Kids

Ideally an individual should learn about the foundations of finance from childhood. This step will aid them in making correct decisions concerning handling money. The different methods by which you can begin incorporating this measure …

- January 28, 2022

- by Angela

9 Common Mistakes First-Time Home Buyers Make

Buying a house for the first time can be pretty stressful. It is easy to make certain mistakes. This article will be your guide to the common mistakes you should avoid when buying a house.

- January 12, 2022

- by Angela

14 Ways to Improve Your Financial IQ

What if you could measure how wisely you spend your money? Are you the sort who blows through their paycheck right away or someone who sets aside money for a rainy day? In this post …

- December 16, 2021

- by Angela

10 Reasons Why Renting May Just Be Better

Many people think that when they buy a house life is magically better. After all, homeownership is the “American Dream”... In reality homeownership isn’t all positives. Do you know the reasons why it is better …

- November 23, 2021

- by Angela

17 Ways to Make Money From Home 2021

Until a few years ago, many people did not even think that working from home would become commonplace. Today it is easier than ever to start your own business with a minimal investment.

- November 15, 2021

- by Angela

Learn Budget Planning From Stay-At-Home Parents

Personal budgets for families are not made by professionals, but oftentimes by the women who runs the household. It may sound stereotypical, but it is still the case in many households that the husband works …

- October 13, 2021

- by Angela

How to Save $5,000 in a Year

Many people wonder how they can save $5,000 in a year. In this post we explore budget expenses that can be trimmed, either by finding less expensive alternatives or cancelling ones that are not used …

- October 5, 2021

- by Angela

8 Profitable Hobbies You Can Monetize

Hobbies are great for relaxing, exploring creativity, and honing your skills at something you are passionate about. However, did you know you could also earn a bit of income from all the time and effort …

- August 30, 2021

- by Angela

Is Freelancing Better vs a Full-Time Job

Many employees due to their small monthly salary or boring work dream of one day becoming independent. Not everyone is cut out for it though.

- August 20, 2021

- by Angela

Budgeting for a Family Trip to Europe

Heading to Europe? This article breaks down what it might cost for airplane tickets, accommodations, dining / food, attractions over varying stays.

- June 25, 2021

- by Angela

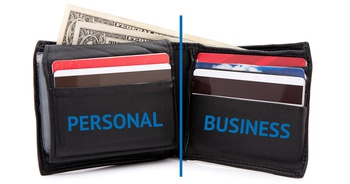

Business vs Personal Bank Accounts for Freelancers?

Will be necessary to open a business bank account? In this post we explain all the information regarding personal vs business bank accounts for freelancers.

- June 8, 2021

- by Angela

How Does Gambling Affect Your Budget?

Gambling can be a great way to have fun and hang out with friends. It is smart to think about how gambling can affect your budget and what the risks are. In some cases it …

- May 7, 2021

- by Angela

Budgeting Guide for Freelancers

Freelancing is a great option for making an income but it does require a bit more work. This includes setting up and sticking to a budget since freelancers essentially run their own small business.

- April 5, 2021

- by Angela

Building an Emergency Fund for Peace of Mind

Have you ever had a sudden expense that you did not expect? The question is not if but when. The next question is, how can you pay for a sudden expense? That is the purpose …