What is an Expense Ratio? Part 2

- April 25, 2017

- by Steven

The components of a fund's expense ratio explained in detail. In short it goes to the fund's management, advertising cost, and company 'slush fund'.

Every time you come across the term expense ratio, you know you’re dealing with an investment cost. Because you know an expense ratio is one of the prices you pay when you invest in mutual funds and ETFs. But if you follow the money, what are you paying for? What exactly does the expense ratio consist of?

The most important thing to remember about an expense ratio is the simple fact that it’s a price you pay to invest in funds. Meaning it’s a cost or a fee (I use fee and cost interchangeably). And this fee reduces your total investment return because that’s what fees do—they transfer money from your pocket to the pocket of somebody else. If you haven’t read What is an expense ratio? Part 1, now might be a good time.

And if you know nothing else about expense ratios other than this—that it’s a cost you incur and costs weigh on your net return—you’re already ahead of the curve because keeping your investment costs low is the Golden Rule of investing. And armed with the knowledge that a fund’s expense ratio is nothing more than a flat fee gives you a critical lens through which to analyze fund options.

But if you drill down further, you might find yourself wondering how expense ratios are calculated. And how investment management companies—who are the creators of mutual funds and ETFs, companies such as Vanguard, BlackRock, Fidelity—determine what expense ratio to charge you.

And thus, you come face to face with the questions posed to you earlier:

What are you paying for? And what exactly does the expense ratio consist of?

Let’s tackle each one separately.

What are you paying for when you incur an expense ratio fee?

You’re paying to cover the cost of operating a given fund—be it a mutual fund or ETF. And this cost is expressed as a recurring yearly percentage of your fund’s assets.

Logistically the way this works is the investment company determines the expense ratio (based on a number of factors I explain in the next question) and then lowers your fund’s share price accordingly, which represents your fund’s Net Asset Value (NAV). Meaning by the time you buy shares in the fund, you don’t even realize you paid a fee because the NAV has already baked in the expense ratio.

But make no mistake, you’re paying this fee.

As a gross simplification, if the actual value—before applying the expense ratio—of one share of Mutual Fund ABC were $100 and the expense ratio were 1%, then you would see the NAV (i.e., share price) of Mutual Fund ABC as $99. Not $100.

Remember: a fund is a product. And just like any product, it takes work to bring a product to life. For a fund, there’s administrative work. Investment and finance work. And marketing work. All this work mashed together comprises the operation of a fund. And all this work is what you pay for—in the form of an expense ratio and in turn lower NAV—when you invest in mutual funds and ETFs.

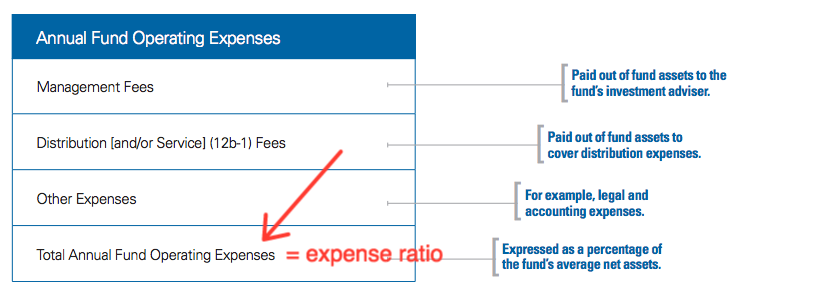

In fact the expense ratio appears as Total Annual Fund Operating Expenses in the fund prospectus. Which brings us to:

What exactly does the expense ratio consist of?

The expense ratio (Total Annual Fund Operating Expenses) consists of three parts—all of which are considered “operational” expenses:

- Management fees

- Distribution fees (12b-1 fees)

- Other Expenses

Source: https://www.sec.gov/oiea/investor-alerts-bulletins/ib_mutualfundfees.pdf

There is a team of finance and investment professionals behind a fund—whether it’s a passive or active fund—providing, well, finance and investment advisory services. And you cover their cost when you pay the Management Fee.

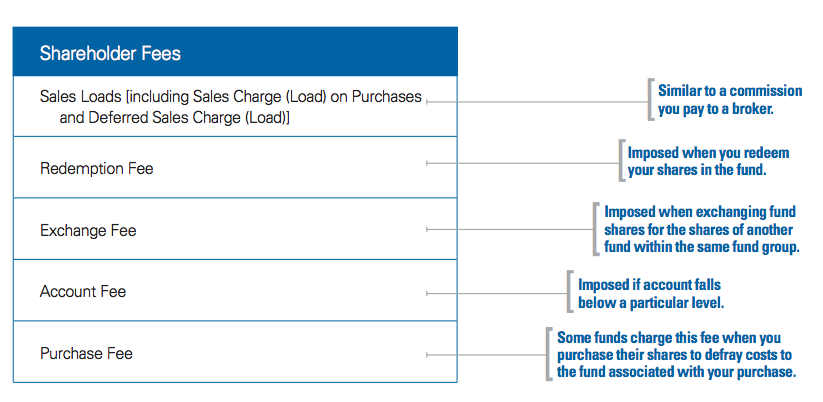

To be sure, the Management Fee does not include transaction costs such as loads or sales commissions, purchase fees, or redemption fees—which make up another major set of fund fees called Shareholder Fees.

Investment companies don’t create a fund so it can sit on a shelf and collect dust. They want you to invest in their fund. And so they market it. They advertise it. And they build up a sales infrastructure to sell you it. All this costs money. And if you’re an investor in the fund, the investment firm provides with you important documentation, e.g., mailing out your prospectus and communicating other fund information to you. And this costs money too. Altogether these costs make up Distribution/12b-1 Fees.

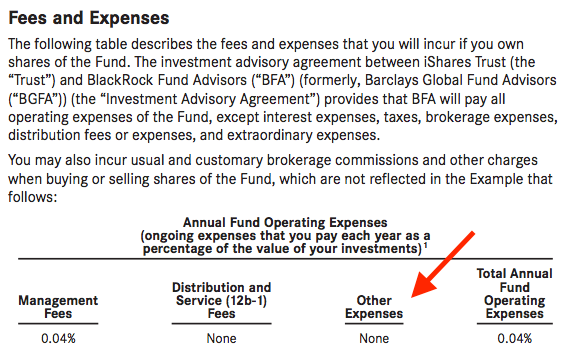

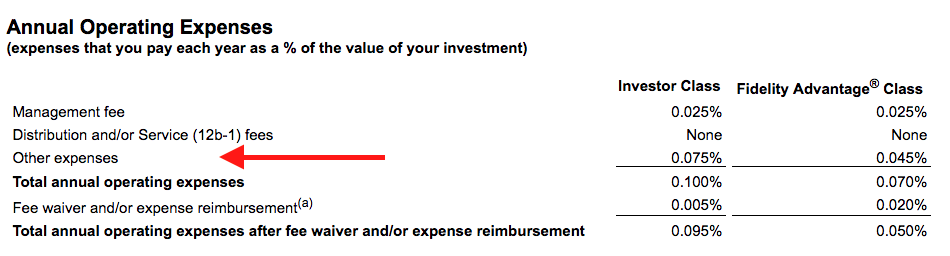

And while it might seem a bit sketchy, any remaining operational expenses form the grab bag category called Other Expenses. I’m not kidding. “Other Expenses” is seriously the technical term. Look at the following fee tables, taken right from fund prospectuses:

Fidelity Spartan 500 Index Fund

Other Expenses include an array of administrative costs such as shareholder service expenses, custodial expenses, legal and accounting expenses, transfer agent expenses, among others.

And that’s that in regards to expense ratios. You’re paying Management Fees. You’re paying Distribution/12b-1 Fees. And you’re paying what might be the world’s sketchiest named fee: Other Expenses.

But before you go, one last thing:

Remember that the expense ratio is not the only cost associated with funds! Consider this definition of expense ratio from the Vanguard 500 Index Fund Prospectus:

A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but it does not include the transaction costs of buying and selling portfolio securities.

These “transaction costs of buying and selling securities” fall under Shareholder Fees.

Source: https://www.sec.gov/oiea/investor-alerts-bulletins/ib_mutualfundfees.pdf

In general, with a discount broker, you should be able to all but eliminate shareholder fees especially if you automate the purchases or buy above a certain amount.

And it's of mission critical importance you take these fees into account too because:

Keeping your investment costs low is the Golden Rule of investing.

Notes:

- Remember that all investments are subject to risk, including the possible loss of the money you invest.

- Remember to read your fund’s prospectus because it details out the fees you pay, among other important fund information.

- SEC Investor Bulletin - Mutual Fund Fees and Expenses (PDF)

- Understanding Fees by Investor.gov — a great list of questions to ask about fees